**Disclaimer — I believe most of Crypto is useless, fuels scams, immoral activities and is bad for the environment.

Switching up gears a little bit this week..

When you receive a paycheck electronically, how do you know that the dollar you receive is your dollar? Short answer is — you don’t.

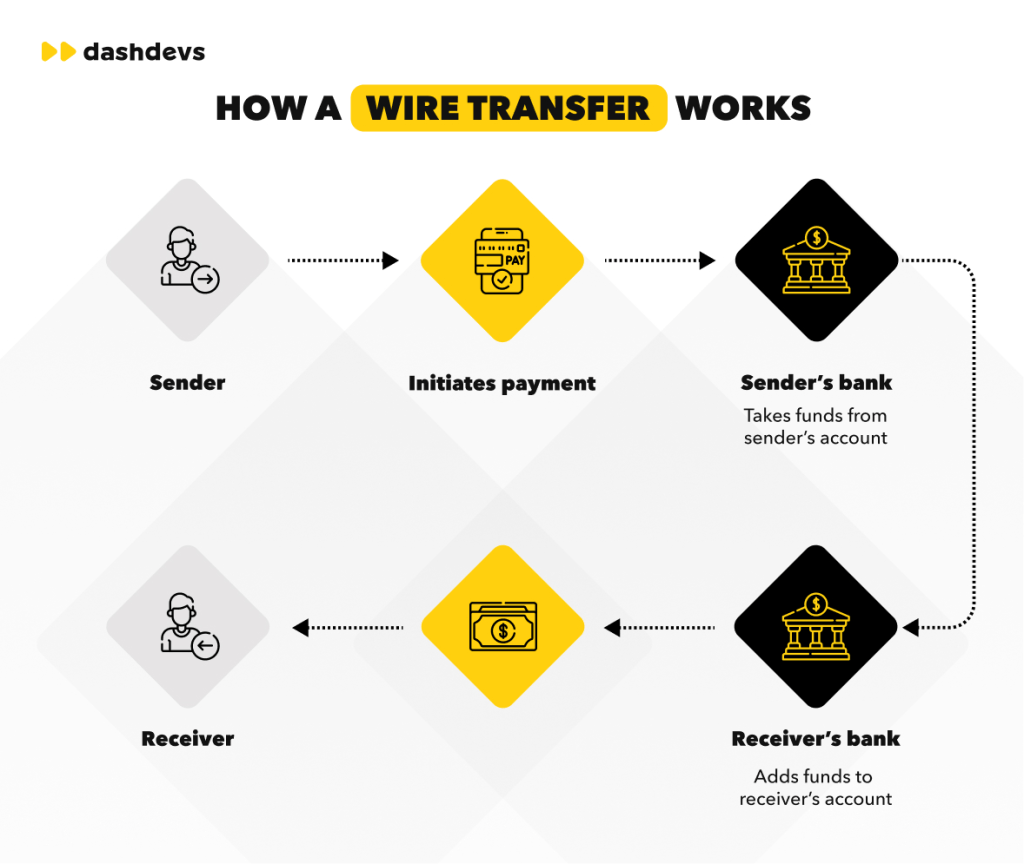

It moves a number from one account to the other, it’s stupidly simple, really. A diagram:

Source – Dashdevs (2024)

These take hours, to days, due to security checks and bank processing times.

Even the dollar’s serial numbers are meaningless—only useful for anti-counterfeiting. They don’t track who holds what.

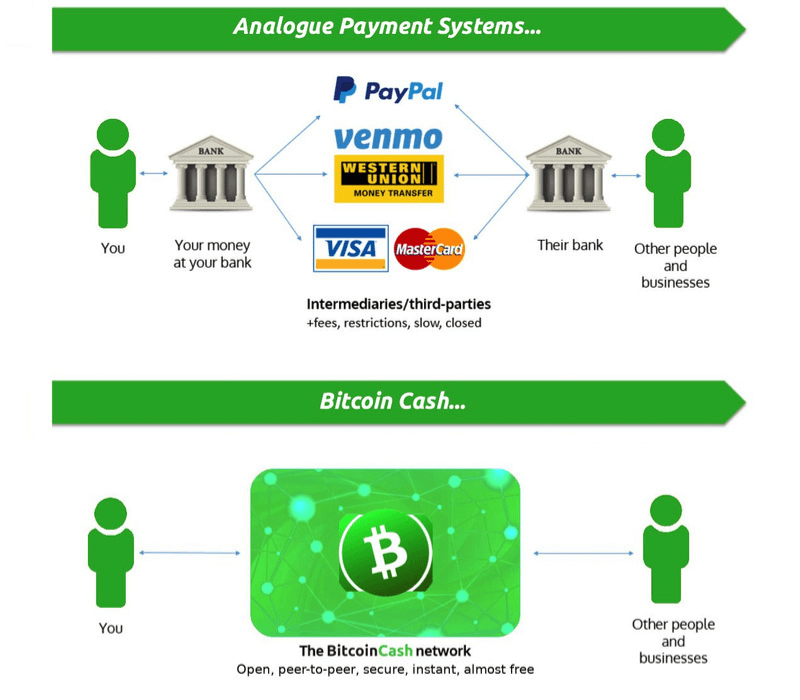

Now, this is how cryptocurrency transactions work (overly simplified):

Figure 2 – OpenGrowth (2021)

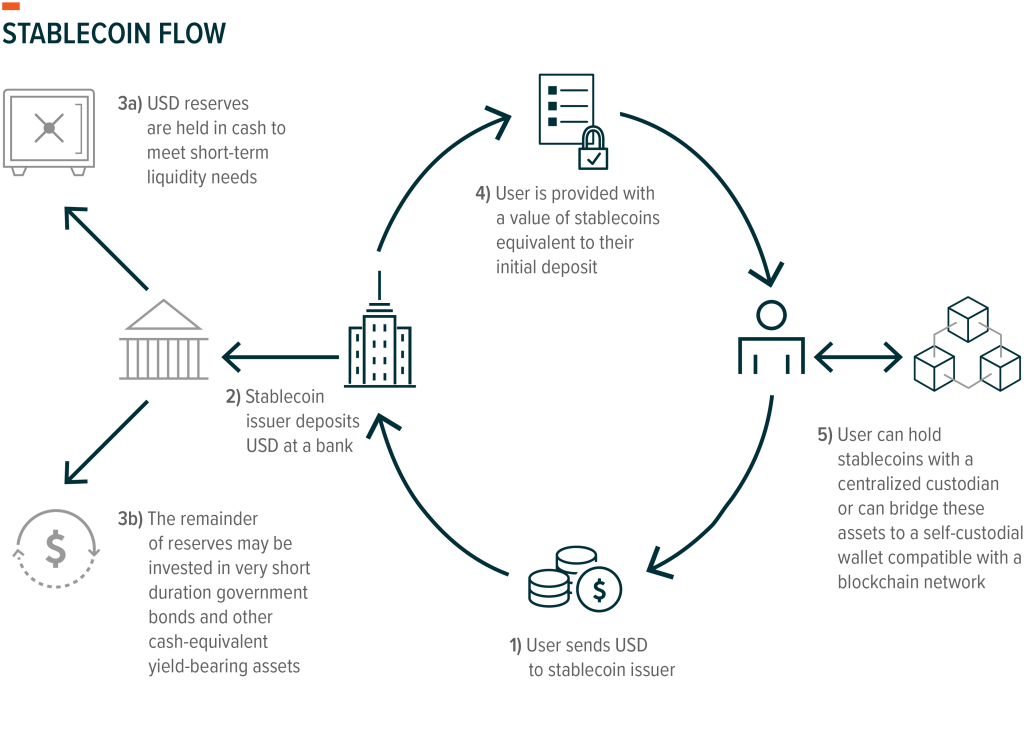

Cryptocurrencies like Bitcoin assign unique traceable IDs to every unit. Bitcoin’s problem is it’s volatile, slow, and deflationary. But stablecoins –tokens pegged to the dollar — take the best part of crypto (traceability + programmability) and remove the volatility.

Source 3 – GlobalX (2023)

If the government would tie the dollar to a cryptographic unique digit, it would:

- Control Corruption: ever dollar has a unique digital ID. Government funds suspected of being inappropriately spent can be traced.

- Tracking government spending: government projects are notoriously wasteful with spending. Below, a chart (with help from ChatGPT):

| Project / Problem | Specific Issue | Stablecoin-Based Solution |

|---|---|---|

| F-35 Fighter Jet Program ($1.7Trillion) | Massive cost overruns with little oversight | Smart contracts release funds only upon verified, on-chain milestone completion. Funds can pause automatically if delivery deadlines are missed. |

| Healthcare.gov Rollout ($2.1 Billion) | Non-functional site at launch with poor contractor performance | Smart contracts tie payments to testable deliverables (e.g. server-load testing). |

| Alaska’s Bridge to Nowhere ($398 Million) | Funds allocated for a bridge to an island with ~50 residents | Smart contracts include automatic feasibility thresholds (e.g., projected usage) before releasing construction funds. |

| Iraq Reconstruction ($8–10 Billion wasted) | Billions unaccounted for, missing or abandoned infrastructure | On-chain disbursements require geo-tagged evidence and real-time IoT inputs confirming delivery or site progress. |

| Solyndra Loan Guarantee ($535 Million loss) | Government-backed solar startup defaulted rapidly | Loan disbursement via stablecoin in tranches, requiring blockchain-logged sales and production benchmarks for next tranche release. |

| Federal COVID Relief Fraud (~$191 Billion) | Billions in fraudulent PPP and unemployment claims | Payments issued as programmable stablecoins only usable at approved vendors or categories, with identity-linked wallets to prevent impersonation. |

3. Anti-inflation: stablecoins would allow real-time adjustment of the money supply:

If inflation rises -> burn just the right amount of electronic dollars.

If deflation occurs -> mint more electronic dollars.

4. Taxes: tax is collected before the money even reaches you (bye-bye IRS). Carbon taxes would also be automatically deducted from high-emission companies.

5. Environmental Impact: no need to mine coins or store dollars, it is virtual and energy-efficient.

No, I’m not a crypto fanboy — but a traceable, programmable digital dollar — might be worthy of consideration. The technology is there.. it’s just up to our governments to embrace it.

Sources:

DashDevs. (2024, October 14). ACH vs Wire Transfer Payments: Key Differences. https://dashdevs.com/blog/ach-vs-wire-transfer/

Global X Research Team. (2023, October 19). An Introduction to Stablecoins. Global X ETFs. https://www.globalxetfs.com/articles/an-introduction-to-stablecoins

OpenGrowth. (n.d.). Bitcoin: The foundation of the payments system and the banking system. OpenGrowth. https://www.blogs.opengrowth.com/bitcoin-the-foundation-of-the-payments-system-and-the-banking-system